Can substitutes for cocoa claim a place in the market? And who will establish a dominant IP position in the area?

Cacao Shortage

The global cacao bean market is facing a challenge. A combination of climate change, crop diseases, and socio-economic pressures in cacao-producing regions has led to a significant decrease in supply. Meanwhile, the demand for chocolate continues to soar, especially in developing markets where chocolate consumption is rising rapidly. As a result, prices for cacao beans have hit record highs, making traditional chocolate products more expensive for manufacturers and consumers alike. This shortage is driving the confectionery industry to explore innovative alternatives that can replicate the beloved taste and texture of chocolate while addressing cost and sustainability concerns.

Alternatives to Traditional Chocolate

Amid this cacao crisis, multiple companies are stepping up with new solutions. One notable entrant is Planet A Foods, the creator of ChoViva, a cocoa-free chocolate made from oats and sunflower seeds. Using advanced fermentation and roasting techniques, Planet A Foods has developed a product to closely mimic the flavor and mouthfeel of traditional chocolate. Currently, ChoViva is on the market and has already partnered with major players like Lindt to create plant-based chocolate bars.

Another trailblazer is Voyage Foods, which has formulated a cocoa-free chocolate alternative using grape seeds, sunflower protein, and shea kernel oil. Their products promise up to an 84% reduction in carbon emissions compared to conventional chocolate, making them an eco-friendly choice. Voyage Foods’ products are already available, and the company is actively scaling up production to meet growing demand.

Meanwhile, Win-Win Food Labs (formerly WNWN Food Labs) has developed a cocoa-free chocolate bar that uses roasted carob, barley, and sunflower flour. Through fermentation, they achieve a taste profile remarkably similar to cocoa-based chocolate. This product is currently on the market, with the company exploring partnerships with large confectionery brands to expand its reach.

Emerging players like Nukoko and Foreverland are also innovating in the space. Nukoko’s bean-to-bar chocolate alternative, made from fava beans and proprietary fermentation methods, is still in the research and development phase but promises to be a game-changer with its 90% reduction in carbon emissions. Similarly, Foreverland’s carob-based chocolate, branded as Choruba, is already gaining traction for its low environmental footprint and ethical sourcing.

Innovation and Patent Opportunity

The rise of these alternatives not only can help address the immediate supply and cost challenges posed by the cacao shortage but also opens up new frontiers for innovation in the confectionery industry. As these companies patent their processes and formulations, they are laying the groundwork for a protected position in a “non-chocolate” confection market.

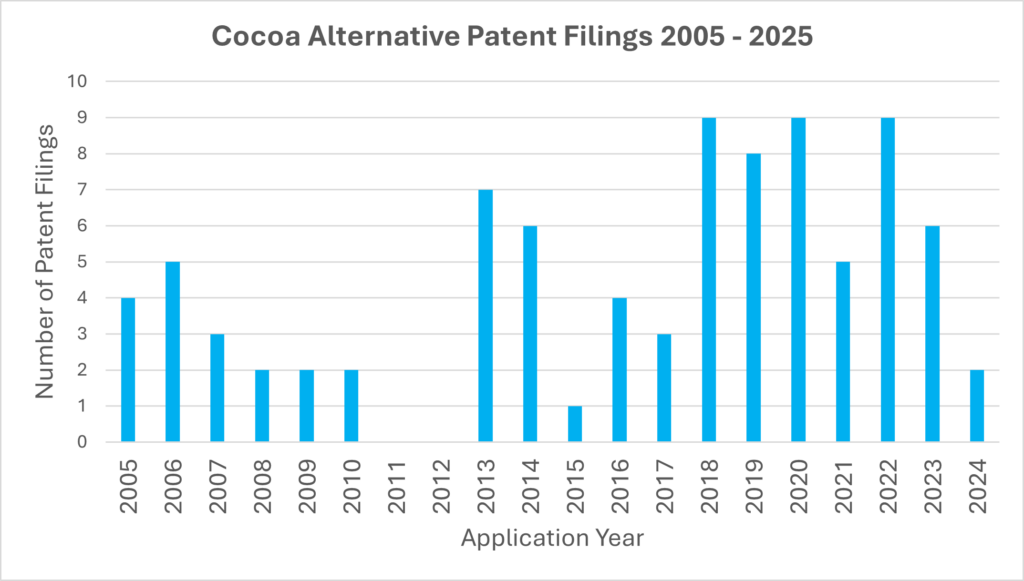

Of the five companies noted above, four of them have at least one patent filing. Conducting a brief study of the cocoa-alternative space shows that the interest in this area isn’t new, and large companies hold some IP in the area. Companies such as Fuji Oil, Nestle, Givaudan and Mars appear in the patent landscape. The chart below shows that investment in patents took a jump around 2012 and shows reasonably steady activity since.

While the patent space is active, it by no means looks crowded yet. It is still early enough for businesses and investors to stake their claim in a sector that could redefine how the world enjoys chocolate-like treats. We suggest studying the cocoa alternatives space in greater detail to identify focus areas for invention, and conduct ideation sessions, such as ipCG’s Invention on Demand®, to create new concepts for IP protection using patents and trade secrets.

Path to Success for Cocoa Alternatives

Market conditions for cocoa alternatives appear more favorable now due to the reduced supply of cacao beans. Proactive IP development, partnerships, and/or licensing can provide a path to a protected IP position in cocoa-free products and take advantage of the current economic situation. Companies that capitalize on the opportunity will have the best chance to become market leaders in this space.